Property Cash Flow Professionals

Improving Property Cash Flow Through Cost Segregation

Requests? Call 480-442-3490

Cost Segregation

PCF PROS Services

What are the steps involved in the process?

What is a Cost Segregation Study?

A Cost Segregation Study is a strategic, tax-saving tool that can be used by companies and individuals who have constructed, purchased, expanded, or remodeled any kind of commercial building or residential rental real estate. The study allows the owner to take advantage of accelerated depreciation deductions and defer federal and state income taxes.

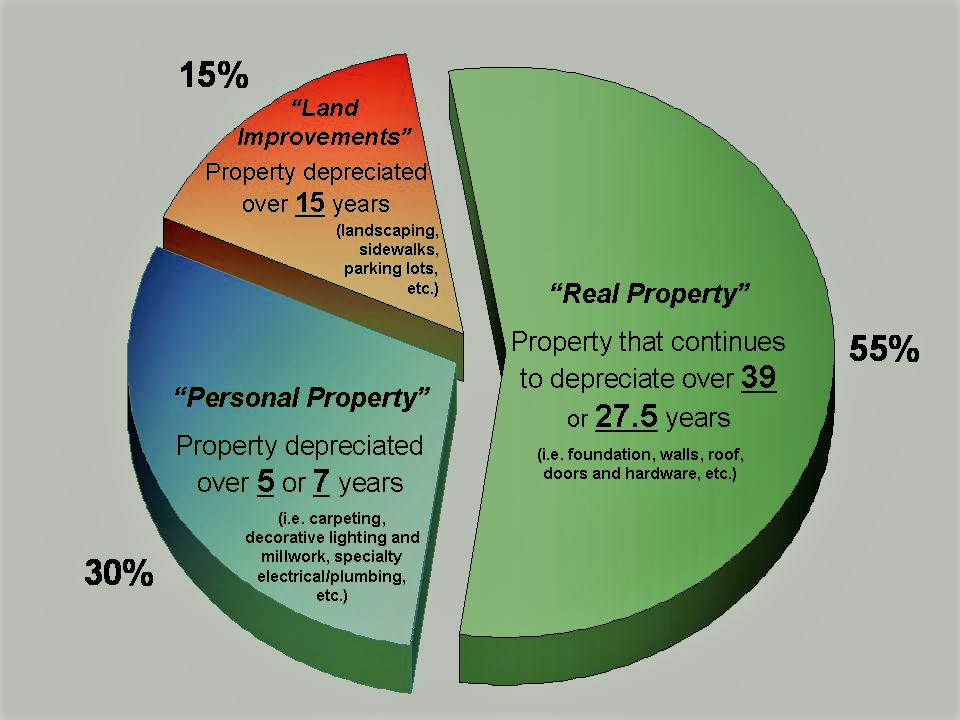

Normally, 100% of the cost of commercial real estate is depreciated over 39 years or 27.5 years. During a Cost Segregation Study, components of a property or leasehold improvement that can be depreciated over a shorter time (5, 7, or 15 years) are identified and reclassified. For example, 30% to 70% of the total electrical costs in most buildings can qualify for 5 or 7-year depreciation.

Typical components that can be reclassified include a building’s non-structural elements, such as carpet, decorative lighting and trim, dedicated electrical and plumbing, security systems, and cabinets; exterior land improvements, such as landscaping, driveways, curbs, sidewalks, fencing, and signage; and indirect construction costs, such as architect and engineering fees and construction permits. The result of a Cost Segregation Study is that a property owner’s tax obligation is reduced and cash flow is increased.

At PCF PROS, we take care to provide our customers high quality services personalized for their unique needs. We are available to take your calls 24 hours a day, 7 days a week. Our staff members are professional, courteous and efficient.

1. Determine if your property qualifies: Any Commercial buildings or Residential Rental property that have been purchased, constructed, expanded, or remodeled since 1987. A study is typically cost-effective for buildings purchased or remodeled at a cost greater than $150,000.

2. Determine your potential benefit of preforming a cost segregation study: Typically clients receive tax savings of greater than 300% of the cost of the study. We will help you determine your potential savings at no cost or obligation.

3. Engage a reputable Cost Segregation firm: The IRS states that a cost segregation study needs to be prepared by a company that has Expertise and Experience in construction process, cost estimating and allocation as well as applicable tax laws. At PCF Pros we have and partner with companies that have over 15 years experience in these areas.

4. Documents gathered: Drawings, invoices, appraisals, tax returns. These documents are then reviewed and studied.

5. A Site survey is executed and completed: In the survey extensive measurements are taken, areas of the building are inspected and photographed to verify and substantiate the value of different assets of the property.

6. All information is evaluated: Our professional staff and highly complex computer program crunches the numbers. Documents and survey data are reviewed in detail and fed into our computer program to allow for the calculation of cost of the tangible assets of the property.

7. Final Report Issued: A digital copy of the final report is emailed to you for use in your tax returns.