Property Cash Flow Professionals

Improving Property Cash Flow Through Cost Segregation

Requests? Call 480-442-3490

The Tangible Property Repair Regulation:

PCF PROS Services

At PCF Pros we can offer this service at a fraction of the cost of doing a full Cost segregation Study.

Repairing your Property or Building?

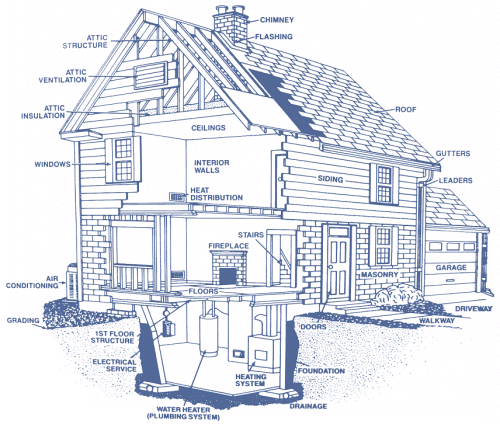

Taxpayers can realize significant benefits from the Tangible Property Repair (TPR) regulations by identifying building components that have been replaced or demolished in current or prior years and claiming retirement loss deductions. However, it is often difficult to determine the tax basis of each component without a cost segregation study. While the IRS agrees that a cost segregation study can be used for this purpose, they also allow the “PPI discounting approach”.

The “PPI discounting approach":

This tool uses the Producer Price Index to discount the new cost of replacing each building component and provides an adjusted value considering the condition of the old building component at the time it was acquired (accomplished by considering the component's normal life and effective age)

At PCF PROS, we take care to provide our customers high quality services personalized for their unique needs. We are available to take your calls 24 hours a day, 7 days a week. Our staff members are professional, courteous and efficient.

Sometimes a full cost segregation study does not make since for you personal needs at the time. PCF Pros offers a Tangible Property Repair deduction calculation using the PPI discounting approach at a fraction of the cost of preforming a full cost segregation study. This calculation can be used to offset the cost of the repairs. This service can be done within 2 business days. Call today or fill in the request form for pricing of this service.

The IRS allows you to completely depreciate components of a building or property that you have or are currently repairing or replacing, allowing for a large deduction that in many cases will pay for a large portion of the repair. The IRS calls this The "Tangible Property Repair Regulation."